Nourishing a Better Future for Women’s Health Through Nutrition

Bluestein’s Take

Our mission at Bluestein is to make the food system better, healthier, and more sustainable – for all. We’ve been heavily focused and bullish on food-as-medicine as a way to heal our bodies and move from treatment to prevention. To that end, our portfolio includes Attane Health (personalized nutrition platform that leverages food prescriptions), Filtricine (precision nutrition), BiomeSense (end-to-end microbiome platform), and Fount (customized performance optimization).

But “for all” is an important callout. One demographic that’s been historically overlooked is women, who make up half of our population. Women’s health issues have traditionally been misunderstood, under-diagnosed, and under-treated, leading to suboptimal health outcomes across life stages.

The time to invest in women’s health is now due to a shift in the status quo for women’s healthcare, increased consumer empowerment, and a deeper appreciation for women’s distinct health needs across life phases. Women’s health is a market primed for growth and is expected to reach $60 billion in value worldwide by 2030, growing over 5% annually.1

Nutrition plays a key role in hormonal health, so as food-as-medicine gains momentum from consumers and the market, Bluestein sees an exciting opportunity at the intersection of food and women’s health. We’re most excited about startups in this space that use nutrition to solve an unmet or underserved therapeutic need, address the specific needs of consumers in one or multiple life phases, provide an innovative treatment modality, and encourage habitual use through demonstrated benefits.

The Time for Women’s Health Solutions is Now

The Gender Gap in Healthcare

Women’s health has historically been largely ignored by the healthcare industry, with female-specific conditions accounting for just 1-2% of healthcare research and innovation.2 For years, medical training, diagnoses, and treatments have had a predisposition to the male physiology, and women have been under-represented in clinical studies until very recently – it wasn’t until 1993 that female participation became required by the National Institute of Health.3 All of these factors have resulted in poor health outcomes for women. For example:

21% of women in the US report that their doctor dismissed their health concerns, compared with just 13% of men.4

Women are 50% more likely than men to suffer from misdiagnosed chronic conditions and pain.

Maternal mortality rates in the US have increased by nearly 30% in recent years, with higher disparities, particularly for black women.5

Many women’s health conditions have no found cures, including endometriosis which affects 1 in 10 women.

Poor health outcomes for women have real economic impacts. Higher healthcare costs and forgone economic participation are directly related to misdiagnoses and suboptimal treatment. As women seek various solutions, costs arise from foregone economic participation and repeated doctors’ visits. In fact, menopause-related hot flashes alone have been estimated to result in $1,400 in health costs and $770 in lost productivity per person per year. Common treatment recommendations for hot flashes range from taking a walk, deep breaths, or carrying a portable fan all the way to antidepressants or epilepsy drugs often prescribed off-label by a doctor. It wasn’t until last year that the FDA approved the first medication specifically for menopausal hot flashes.6

The gap in women’s health is exacerbated by the perception of women’s health issues as taboo. Taboos around conditions like period pain or sexual health can create a “culture of silence,” which limits access to knowledge and care and often prevent women from mentioning their health concerns to a doctor.7 This is beginning to change, partially driven by the prevalence of online conversations around these topics, but taboos are deeply ingrained and can perpetuate inequities.

Last, women’s health is often synonymous with reproductive health. However, women’s health is much broader – not only including female-specific conditions including fertility, maternal health, and menopause, but also general health conditions that impact women differently from men like mental health, digestive health, bone health, and certain cancers. Each of these areas is important to consider in thinking about the opportunity.

The Nutrition Gap in Healthcare

Equally important, there has been a paradigm shift in how people think about nutrition as it relates to overall health. Consumers are prioritizing health and wellness in daily choices while the medical community is rethinking how nutrition can influence chronic care. In the US, the food-as-medicine market was estimated at $90.5 billion in 2022 and is expected to grow at a nearly 5% CAGR through 2030.8 Efficacy-backed nutrition products, medically tailored services, and clinical discovery platforms enabled by nutrition science are all advancing the category to address chronic health conditions and unmet health needs. The market trends in nutrition, combined with the high unmet need in women’s health create an attractive investment opportunity within the food-as-medicine category.

Changing the Status Quo in Healthcare

On a brighter note, in recent years, education around women’s health issues has been on the rise. Healthcare practitioners and women’s health advocates have drawn attention to gender disparities in healthcare, helping to steer the national conversation. Real-world studies have also validated the gap in women’s health outcomes, encouraging action across health systems.

With increased education and awareness, both private and public sectors have directed resources to combating woman’s health issues. In November 2023, the White House issued a memorandum on Women’s Health Research[i], an initiative aimed at fundamentally changing how women’s health is prioritized and addressed in the U.S. Similarly, initiatives like the Women’s Health Innovation Coalition are bringing investors, researchers, policymakers, and entrepreneurs together to focus on women’s health issues.9

With these macro-level changes, investment in the women’s health space has accelerated. In 2022, women’s health companies received over $1.7B of funding, a 5x increase since 2018.10 Such investments have led to more solutions tailored to women, including wearable devices and tracking mechanisms aimed at improving diagnosis rates. Investments in the women’s health space are faring well, even amidst a challenging venture environment since 2021.11 A once overlooked segment, menopause in particular has seen a huge influx of investment and innovation, and menopause-related products are predicted to reach $5.3 billion in value in 2023.12

Innovative solutions are being propped up by an evolving healthcare system. Employers are seeking to expand employee benefits to include women’s health solutions while payers are improving coverage and reimbursement options. These forces are changing the tide in women’s health and giving consumers solutions that have never been possible, including on the nutrition front.

Consumer Empowerment

Women are the primary decision-makers for themselves and their families, where mothers make 80% of their children’s health decisions.13 As 78% of women are their household’s primary shopper, activating them is crucial.14

A few macro-events are encouraging women to advocate for their health needs at higher rates as well. The COVID-19 pandemic reinforced the importance of health and wellness for consumers. In addition, the overturning of Roe v. Wade energized many women to focus on protecting and improving their health needs.

Thought leaders have also been using social media platforms to arm consumers with information about their health and treatment options. Women’s health influencers have amassed large numbers of followers, which speaks to how consumers are craving information. For example, OBGYN Dr. Natalie Crawford has a large online following in addition to a podcast and Masterclass where she educates followers on topics ranging from fertility to ovulation irregularities. A singular post from Dr. Crawford on the normalization of period pain garnered over 2.7 million views in just 24 hours on TikTok.15

Nutrition is a key factor cited by influencers discussing hormonal health. This includes conversations on the role of diet in fertility, miscarriage, and PCOS among others. Both Dr. Robin Berzin and naturopathic endocrinologist Dr. Jolene Brighten, for example, often highlight how diet and supplements can be used to address chronic and acute hormonal health issues. Specific food or ingredient recommendations for treating conditions like perimenopause, female hair loss, and gut health are common. Seed cycling, a practice of syncing one’s menstrual cycle to the consumption of certain seeds, is a rising trend that has gained traction on social media. Other trends related to nutrition and women’s health include intermittent fasting, hormone tracking, and transitioning birth control methods. Celebrity influencers are also driving consumers to action, leveraging their vast social media followings to help change the narrative around nutrition and health (e.g. Lemme by Kourtney Kardashian Barker and Pendulum by Halle Berry).

Online influencers and experts help to normalize topics and break taboos. Women can then feel empowered to discuss bloating, hot flashes, and period pain with friends and their doctors to identify symptoms and find solutions. As the role of diet is more readily recognized as a tool for addressing health issues, there’s a significant opportunity for nutrition-focused companies who understand a female’s health needs to generate traction.

Distinct Needs across Life Phases

Zooming out, a typical woman requires care across her various life phases, each with distinct needs. A strong understanding of each life phase is required to enable breakthrough innovation. Below we’ve outlined the key life phases across the woman’s health journey and highlighted the current trends in each category.

Sexual Health & Menstruation: From the start of menstruation, women have needs that include contraception, period care, and sexual wellness. Emerging trends in this space include period pain care, seed-cycling, cycle tracking, and non-hormonal birth-control. According to Mintel, 1/4th of women prefer not to interfere with their body’s natural processes and instead seek out holistic wellness which includes diet, exercise, and mindfulness.16

Fertility: The average age of first-time mothers has been steadily increasing over the years. In 2021, the average age for all first-time mothers was 27.3 years old, with White and Asian first-timers skewing older at 28.1 and 31.2 respectively.17 With more women electing to delay childbearing, infertility rates have increased. Approximately 1 in 6 females worldwide have struggled with infertility, with higher rates experienced in middle- to high- income countries.18 Women in this life phase range from early 20s through late 30s. Emerging trends include tracking and testing devices, fertility coaching, egg freezing, and mental health support. Consumers in this phase have a high willingness to spend, especially as they become more affluent. Nutrition has become increasingly important in this category, with an opportunity for companies to integrate nutrition products with fertility services and devices.

Maternity: 17% of U.S. adult women are on the maternal journey, which has been decreasing overtime as birth rates have been on the decline. Women are generally having fewer children, while those who are giving birth at a higher frequency tend to have less disposable income.19 This, in addition to the inflationary environment suggests that women who are having more children will require budget-friendly options. Trends in this phase include affordable & accessible lactation, mothers’ sexual wellness, postpartum mental health, mother & baby nutrition, and full family support services. This is an area that is ripe for federal aid and funding. In May 2023, the US HHS Department announced the deployment of $65 million of funding targeted at addressing the maternal health crisis in America.20

Menopause: Over 40% of adult women fall within the peri-menopause, menopause, or post-menopause life phase, totaling over 1 billion women worldwide.21 The average age of menopause is 51, with the menopausal transition lasting from seven to 14 years.22 Women entering this category are on average more affluent and have traditionally struggled to find effective treatment solutions.23 Trends in menopausal care include telehealth platforms, self-diagnostic tools, personalized nutrition, and pain relief products. Given the number of women, higher ability to spend, and length of this life phase, there have been a considerable number of new startup entrants targeting menopause.

In addition, women require healthcare solutions for specific conditions as well as primary & holistic care. Specific conditions include UTIs, endometriosis, PCOS, women’s oncology, uterine fibroids, incontinence, among others. Primary & holistic care is also needed across life phases as women have distinct needs for general health conditions, including mental health, hormone health, and digestive health (digestive health for example is a condition that afflicts women more than men).24

The Opportunity in Women’s Health & Nutrition

Innovation in women’s health encompasses a broad set of modalities including those that integrate nutrition into their solutions. The key modalities include:

Wearables, devices, and testing: This category encompasses technology that allows women to track menstruation, ovulation, hormones, and other health metrics. Wearable device companies like Femtek or Oura as well as testing services companies like Natural Cycles all leverage data to inform women about their health and fertility, and companies like Stix offer tests for a variety of conditions and metrics including UTIs, vaginal pH levels, yeast infections, and pregnancy. Some companies leverage the data and insights to provide recommendations for nutrition products, which we see as a lever for driving value in the space.

Digital health/telehealth services: These solutions provide virtual access to providers dedicated to women’s health issues. Companies in this space provide accessible and differentiated care focused on prevention and holistic care for women across various conditions, often incorporating nutrition. This category, which includes companies like Maven Clinic, Partum Health, and Elanza has experienced high growth over the past few years, especially post-pandemic.

Feminine care products: This category provides women with new products to care for their bodies’ needs across life phases, which can include food and supplements in tandem with other physical goods. Innovation in feminine care CPG products includes examples like Jovi’s period pain relief patches and Bodily’s pumping and lactation bras.

Food and supplements: Companies in this space provide women with products to optimize nutrition for improved hormonal health. Diet has become an increasingly important modality for addressing holistic health, and food and supplements are being integrated into offerings across categories.

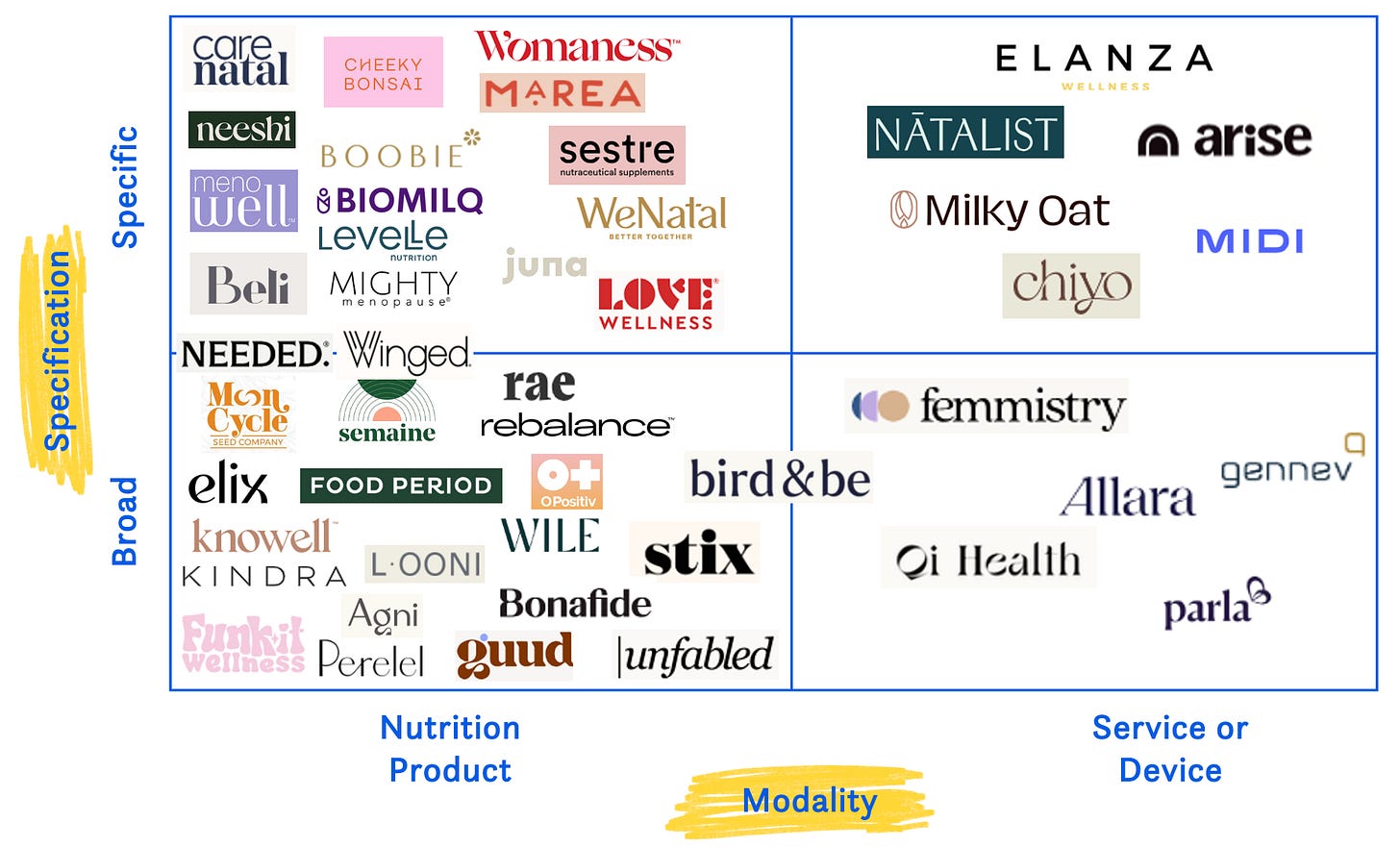

The chart below maps out companies that offer nutrition-based solutions for addressing needs across a woman’s life phases, including the product and service modalities outlined above.

In addition, we mapped companies by health area specification and delivery mechanism to demonstrate how we evaluate opportunities in each category. When assessing specification, we placed companies along the axis based on how broad or specific their health area focus is. On the modality axis, we categorized companies based on whether they offer a product or a service. Most companies are concentrated in the product category (feminine care & nutrition products) as opposed to the services category (wearables, devices, testing & digital health/telehealth services). Many companies integrate traditional CPG nutrition products with services like coaching or telehealth (e.g. Qi Health), diagnostic devices/services (e.g. Stix), and even feminine care products.

Key Insights by Category

Along the specification axis, we’ve found that the most targeted solutions generally have higher unmet need, but the market niche may be smaller. While this indicates a smaller total addressable market (TAM), consumers without adequate solutions are more likely to pay higher prices and adopt solutions more quickly. Thus, solutions addressing acute health conditions can have a higher customer lifetime value, as is the case with infertility. Within specific health conditions, most whitespace exists in large markets like fertility, woman’s oncology, pelvic floor conditions, or endometriosis where the need is elevated. For conditions where there are few solutions, there exists greater potential for nutrition products to aid in pharmaceutical intervention or personalized health plans.

One key insight is that companies often start with one or two targeted health areas before expanding into a broader set of specific conditions or health areas. This strategy makes sense for activating a larger TAM, while still addressing acute conditions with the stickiest customers. When treating women’s health more broadly (i.e., women’s multivitamin), it can be difficult to differentiate, thus branding and efficacy become very important.

We’ve found that clinically backed ingredients are expected by consumers in the nutrition product space; therefore, this is not a key differentiator. Brands must ensure that a product demonstrates benefit on the desired goal to effectively drive repeat consumption.

In terms of the innovation modality, there is a spectrum between a traditional product and service for which nutrition-based solutions can be incorporated. While there’s a higher concentration of companies delivering traditional CPG products, more whitespace exists within nutrition services and devices. The integration of nutrition in the service/device category may be more difficult in early phases of a company lifecycle, though we view it as an expansion opportunity to drive added value for consumers.

For traditional CPG nutrition products, it is challenging to be truly disruptive without proprietary IP. This can be examined by simply visiting the supplement isle in your local grocery store. Amongst the wide variety of supplements in the women’s health category, most brands use the same commonly found ingredients with little differentiation outside of formulation or branding. Therefore, we believe that companies in this category who incorporate more service-based solutions like health tracking or subscription models will be the winners in generating higher customer loyalty.

Within women’s health, most service-based companies exist outside of the nutrition space (e.g. Maven, Partum Health, Carrot). We see an opportunity for telehealth or device/testing services to integrate nutrition into their offerings to provide more holistic solutions for consumers. This is especially true given that service-oriented companies have greater opportunity to educate and empower patients. By leveraging data, service-oriented companies can provide personalized nutrition guidance to help consumers achieve their health goals.

Also relevant on the modality spectrum, unit economics for CPG products tend to be less favorable than service-based businesses given their higher cost of goods sold, especially if lack of efficacy doesn’t lead to repeat purchases. To succeed in women’s health and nutrition, companies must close the feedback loop that drives consumers to become repeat customers. Solutions that enhance a woman’s understanding of her body or advance her health goals will achieve this. Companies must also strive to differentiate with clinically supported claims, branding, and customer acquisition strategies.

Evaluative Criteria

To evaluate opportunities in the space, we first start by assessing how strong the solution is within food-as-medicine, answering key questions: How pervasive is the therapeutic need? How effective is the solution? What regulatory or channel barriers could affect speed to market? And is the solution defensible? Using this framework helps us to narrow down the best potential investment opportunities.

Then, to evaluate women’s health opportunities specifically, we go beyond these to ask — does the solution:

Focus on an underserved therapeutic need and/or specific life phase?

Encourage habitual use driven by demonstrated efficacy or brand loyalty?

Deliver value for women with a differentiated treatment modality?

The best solutions serve specific, unmet therapeutic needs, drive value from ‘feelable’ added benefit(s), and activate consumers to make repeat purchases to improve their nutrition and health.

What’s Next

This space is fast-moving, and we’re eager to see it develop as more research, funding, and innovation emerge to address female health needs. At Bluestein, we’re excited to back the next generation of founders who are building a healthier food system. If you’re an entrepreneur in this space or know of one, we’d love to hear from you. You can reach us at info@bluesteinventures.com.

A big thank you to our MBA intern, Meghan Burke, for her work on this!

Sources

Women’s Health Market Size & Share, Growth Report, 2030 (grandviewresearch.com)

Why is women’s healthcare globally so often overlooked? | World Economic Forum (weforum.org)

Women’s Health Care Utilization and Costs: Findings from the 2020 KFF Women’s Health Survey | KFF

2021_ahr_health-disparities-comprehensive-report_final.pdf (americashealthrankings.org)

FDA approves first drug designed to treat hot flashes - Harvard Health

Report finds taboos in women’s health can limit access to knowledge and care | Globalnews.ca

Nutritional Supplements Market Size & Share Report, 2030 (grandviewresearch.com)

Memorandum on the White House Initiative on Women’s Health Research | The White House

Despite 2022’s headwinds, women’s health startups did better than ever before | TechCrunch

SPINS Market Report

78% of women identify as the primary household shopper | Supermarket News

Are Women’s Health Influencers the New ‘It Girls’ of Instagram? – SheKnows

Why gastrointestinal disorders afflict women more often | ScienceDaily